What Are The Title Loans Requirements I Need To Remember?

Considering a title loan? While we here at Carolina Title Loans, Inc. do not have strenuous title loans requirements, there are a few things that you may wish to consider before you obtain a title loan from us.

The Title Loans Requirements You Need To Know

Follow along as we discuss the things you’ll need to think about before applying for a title loan.

Your Vehicle's Title Must Be Lien-Free

Title loans can only be issued against lien-free titles. This means that if you currently have outstanding financing against your vehicle's title, you won't be able to obtain a title loan.

If you are unsure whether you have a lien on your title, you can either look at your vehicle's title (it will list them clearly) or get in touch with the DMV.

You Must Be Able To Provide Access To Your Vehicle

While Carolina Title Loans, Inc. can issue title loans between $601 and $15,000, we can only lend based upon your vehicle's value. This means that we need to be able to inspect your vehicle physically. If we cannot do that (i.e., your vehicle is located out of the state), then we cannot issue a loan. This also means that we cannot issue a loan based upon photographs of your vehicle, for example.

Don't worry if your vehicle isn't roadworthy. We can come and visit you to inspect your vehicle.

Although, do bear in mind that the current condition will always impact your vehicle's value. So, a vehicle that isn't roadworthy will attract a far smaller loan value than one that is.

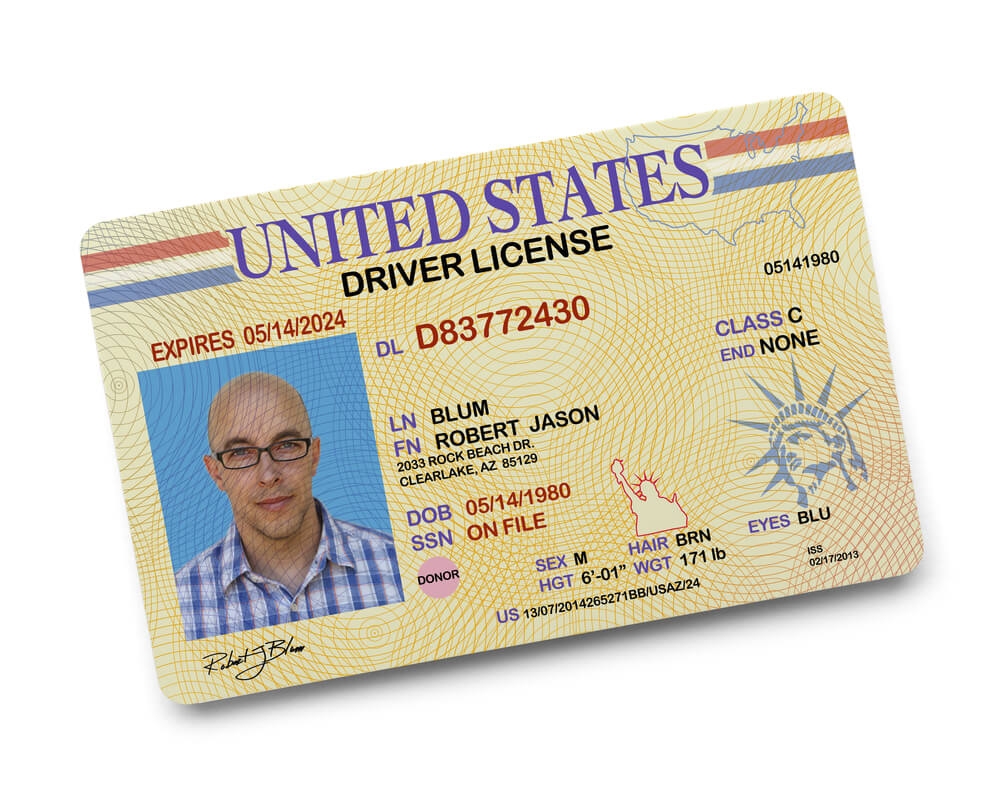

You Must Have an ID

Carolina Title Loans, Inc. can only accept either a driver's license or another state-issued ID. We cannot use any other form of identification when you receive a title loan.

You Do Not Need To Provide Your Income

That's it for the title loan requirements and, as you can see, there aren't that many! That’s why we’re also going to cover the things we don’t require that make getting a title loan easy through Carolina Title Loans, Inc. One of those is proof of your income. Title loans are often obtained by those who may not necessarily be in the best financial position. This means that you can rest assured that nobody will ask you where your income is coming from. For instance, it doesn't matter whether you are employed or receiving benefits.

We will not ask you to provide information on what you are planning on using the loan for, though please do bear in mind that they have been designed for dealing with emergencies.

Bad Credit Can Be Considered

Many people are reluctant to apply for a title loan because they feel that their credit isn't in a good position. We understand. However, you should also remember that because a title loan is a secured loan, the requirements when it comes to credit score may be a bit more relaxed.

We always try to consider a person's current situation when determining whether we can loan cash. So, if other companies have turned you down, it doesn't necessarily mean that we will.

You Do Not Need a Checking Account

While having a checking account is always ideal, there are no requirements to have a checking account when you get a loan from us. We have alternative ways to provide you with the cash you borrow. You can discuss those methods with us when you come and borrow cash!

If you have a checking account, we can normally have the cash sitting in your bank account in just a few hours.

Meet the Title Loans Requirements? Here Is What You Need To Do Next

Now you know the title loans requirements, you’re ready to visit Carolina Title Loans, Inc. and start the process.

The process is always kicked off by filling in the title loan inquiry form on this site. If you feel like calling us directly, then you can do that instead. In both cases, you will end up talking to one of our team members on the phone. They will double-check that you meet the loan requirements, and they will explain the rest of the process.

During the phone call, you will be asked how you want your vehicle to be inspected. We can either come to you, or you can come to your closest Carolina Title Loans, Inc. borrowing location.

Your vehicle will undergo a five-minute inspection, and we will check your documents. If we can approve you for a title loan, you will be told right away. After that, all that’s left is to sign your loan agreement and wait for that cash to land in your bank account.

The inquiry process can take as little as 30-minutes, while the cash transfer process can take a few hours. That part is dependent on your bank and not us, however.

Get a Title Loan Today

The title loans requirements with Carolina Title Loans, Inc. are minimal. Assuming you have a lien-free title to your vehicle, then you are already well on your way. Get in touch with us and you could potentially get your hands on the emergency cash that you need today.

Note: The content provided in this article is only for informational purposes, and you should contact your financial advisor about your specific financial situation.